Virtual digital assets

What are they

- A virtual digital asset is proposed to mean any information or code or number or token (not being Indian currency or any foreign currency), generated through cryptographic means or otherwise, by whatever name called, providing a digital representation of value which is exchanged with or without consideration, with the promise or representation of having inherent value, or functions as a store of value or a unit of account and includes its use in any financial transaction or investment, but not limited to, investment schemes and can be transferred, stored or traded electronically

Why in News:

-

- The Finance Minister proposed a 30% tax on income from virtual digital assets, such as cryptocurrencies , non-fungible tokens (NFTs), DeFi (decentralised finance) .

- Prima facie, this excludes digital gold, central bank digital currency (CBDC) or any other traditional digital assets,

- The term central bank digital currency (CBDC) refers to the virtual form of a fiat currency. A CBDC is an electronic record or digital token of a country’s official currency. As such, it is issued and regulated by the nation’s monetary authority or central bank. As such, they are backed by the full faith and credit of the issuing government.

- “As per the Finance Minister of India, A currency is a currency only when it issued by the central bank, even if Crypto, anything that is outside of that we loosely refer it to cryptocurrency but they are not currencies.”

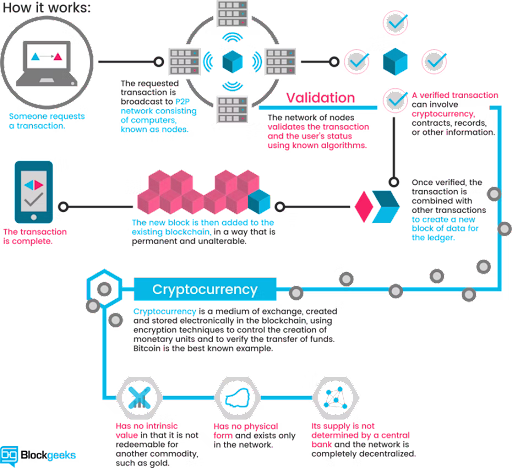

What is a Cryptocurrency?

-

- A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend.

- “Crypto” refers to the various encryption algorithms and cryptographic techniques that safeguard these digital assets.

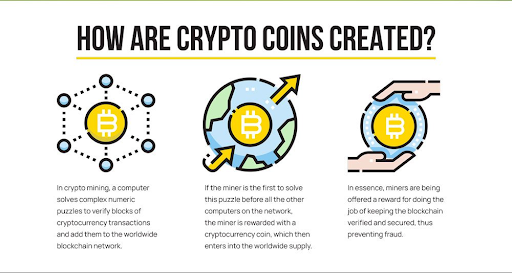

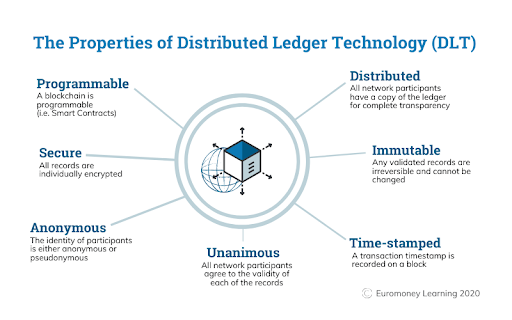

- Many cryptocurrencies are decentralized networks based on blockchain technology—a distributed ledger enforced by a disparate network of computers.

- The first blockchain-based cryptocurrency was Bitcoin, which still remains the most popular and most valuable.

- Some of the competing cryptocurrencies are Litecoin, Peercoin, Namecoin, Ethereum, Dash, Monero, ZCash, Cardano and EOS.

- To read more: https://officerspulse.com/cryptocurrency-and-blockchain/

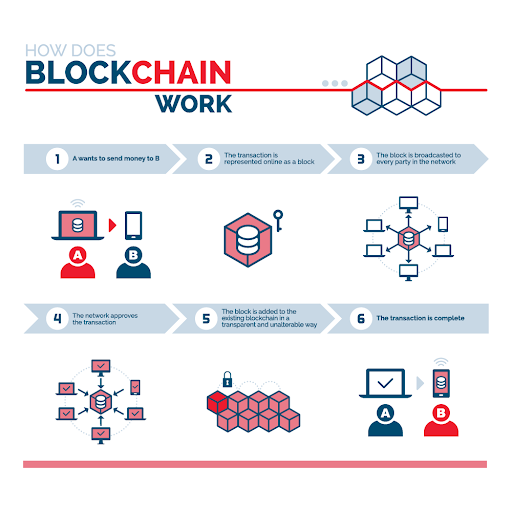

What is Blockchain?

- A blockchain is a distributed database, meaning that the storage devices for the database are not all connected to a common processor.

- It maintains a growing list of ordered records, called blocks.

- Each block has a timestamp and a link to a previous block.

- Users can only edit the parts of the blockchain that they “own” by possessing the private keys necessary to write to the file.

- Cryptography ensures that everyone’s copy of the distributed blockchain is kept in sync.

- The concept was introduced in 2008 by Satoshi Nakamoto, and then implemented for the first time in 2009 as part of the digital bitcoin currency; the blockchain serves as the public ledger for all bitcoin transactions.

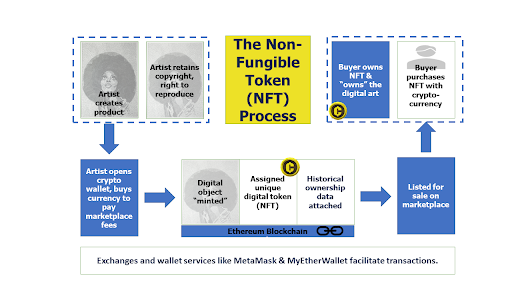

What is a Non-Fungible Token

- In economics, a fungible asset is something with units that can be readily interchanged – like money.

- Non-fungible tokens or NFTs are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other. Unlike cryptocurrencies, they cannot be traded or exchanged at equivalency. This differs from fungible tokens like cryptocurrencies, which are identical to each other and, therefore, can be used as a medium for commercial transactions.

- For example, one Bitcoin is always equal in value to another Bitcoin. This fungibility characteristic makes cryptocurrencies suitable for use as a secure medium of transaction in the digital economy.

- NFTs shift the crypto paradigm by making each token unique and irreplaceable, thereby making it impossible for one non-fungible token to be equal to another.

- NFTs are unique cryptographic tokens that exist on a blockchain and cannot be replicated.

- NFTs can be used to represent real-world items like artwork and real-estate.

- Tokenizing” these real-world tangible assets allows them to be bought, sold, and traded more efficiently while reducing the probability of fraud. The digital tokens can be thought of as certificates of ownership for virtual or physical assets.

- NFTs can also be used to represent individuals’ identities, property rights, and more.

Example of an NFT

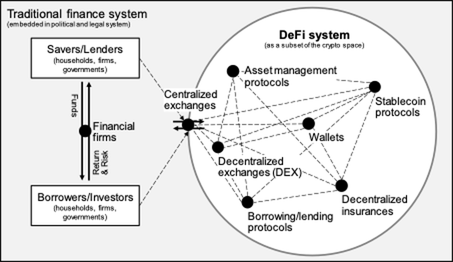

What is DeFi (decentralised finance)

- Decentralized finance (DeFi) is an emerging financial technology based on secure distributed ledgers similar to those used by cryptocurrencies. The system removes the control banks and institutions have on money, financial products, and financial services.

- Decentralized finance eliminates intermediaries by allowing people, merchants, and businesses to conduct financial transactions through emerging technology. This is accomplished through peer-to-peer financial networks that use security protocols, connectivity, software, and hardware advancements.

- From anywhere you have an internet connection, you can lend, trade, and borrow using software that records and verifies financial actions in distributed financial databases.

- Some of the key attractions of DeFi for many consumers are:

- It eliminates the fees that banks and other financial companies charge for using their services.

- You hold your money in a secure digital wallet instead of keeping it in a bank.

- Anyone with an internet connection can use it without needing approval.

- You can transfer funds in seconds and minutes.

- The components of DeFi are stablecoins, software, and hardware that enables the development of applications. A stablecoin is a digital currency that is pegged to a “stable” reserve asset like the U.S. dollar or gold.

References:

- https://indianexpress.com/article/explained/virtual-digital-assets-vs-digital-currency-explained-7752936/

- https://www.thehindu.com/todays-paper/fm-moots-tax-on-virtual-assets/article38362221.ece

- https://www.investopedia.com/non-fungible-tokens-nft-5115211

- https://www.bbc.com/news/technology-56371912

- https://www.investopedia.com/decentralized-finance-defi-5113835

[…] economy, etc. Keep an eye out for any substantive news related to Economics, such as cryptocoin, DeFi( Decentralised Finance), NFT(Non-Fungible Tokens), etc. Hence, those related to economics, that is prominently featured must be studied as well. […]

[…] https://officerspulse.com/virtual-digital-assets/ […]