GST Compensations

What is it?

- The GST regime, launched on July 1, 2017, introduced a uniform indirect tax structure across the country by merging various state and local-level levies.

- Under the GST compensation Act 2017, states are guaranteed full compensation for any revenue loss for the first five years after the introduction of the GST.

- For the purpose of calculating the compensation amount in any financial year, year 2015-16 will be assumed to be the base year, from which revenue will be projected. The growth rate of revenue for a state during the five-year period is assumed to be 14% per annum.

- Any shortfall has to be compensated from the receipts of Compensation Cess levied on luxury goods and sin products such as liquor, cigarettes, aerated water, automobiles, coal and other tobacco commodities.

Revenue shortfall

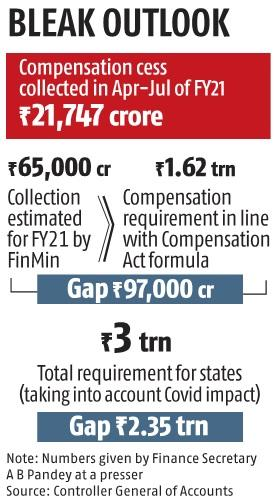

- The goods and services tax revenue has slowed to a trickle on account of a slowing economy, the COVID pandemic and subsequent lockdowns.

- As a result, the collections will not be enough to meet the committed 14% annual increase in states’ GST revenue, as provided in the constitutional amendment.

- The centre has computed this shortfall at an estimated Rs 2.35 lakh crore but determined that only Rs 97,000 crore of that is on account of GST implementation, the rest is due to the pandemic.

Background

- Recently, the Centre presented two options before the states to bridge their estimated GST revenue shortfall in FY21, both involving the states themselves borrowing from the market in the year.

- The loans will be serviced via the proceeds of the relevant compensation cess, which will apply on the specified demerit goods for a year or more beyond the current end date of FY22.

Key details of the two options:

Option 1:

- The shortfall arising out of GST implementation (calculated at Rs 97,000 crore approximately) will be borrowed by States through issue of debt under a Special Window coordinated by the Ministry of Finance.

- The interest on the borrowing under the Special Window will be paid from the Compensation cess as and when it arises until the end of the transition period (2022). After the transition period, principal and interest will also be paid from proceeds of the Cess, by extending the Cess beyond the transition period for such period as may be required.

- The state will not be required to service the debt or to repay it from any other source.

- The borrowing under this special window will not be treated as debt of the state for any other norms prescribed by the Finance Commission.

Option 2:

- The entire shortfall of Rs 2,35,000 crore (including the Covid-impact portion) may be borrowed by States through issue of market debt.

- The interest shall be paid by the States from their resources.

- The centre will repay principal on such debt from compensation cess proceeds collected after the transition period ends in July 2022.

- To the extent of the shortfall arising due to implementation of GST (Rs 97,000 crore), the borrowing will not be treated as debt of the state.

- The states were asked to convey their choice to the Council.

State’s borrowing limit

- In May, the Central government allowed state governments to hike their borrowing limits from 3% to 5% of Gross State Domestic Product (GSDP) under the Fiscal Responsibility and Budget Management (FRBM) Act.

- However, the Centre attached conditions such as universalisation of ‘One Nation One Ration Card’, ease of doing business, power distribution, and augmentation of urban local body revenues for the increased borrowing space, permitting only 0.5 per cent of GSDP as an unconditional increase.

- Under the terms of Option-1, besides getting the facility of a special window for borrowings to meet the shortfall arising out of GST implementation, States are also entitled to get unconditional permission to borrow the final instalment of 0.5% of GSDP out of the 2% additional borrowings permitted by the Government of India.

- No FRBM relaxation has been mentioned for Option 2 so far.

Why in News?

- The Ministry of Finance (MoF) has permitted as many as 20 states, who have exercised Option-1, to raise ₹68,825 crore through borrowings to meet the GST revenue shortfall.

- Additional borrowing permission has been granted at 0.5% of the Gross State Domestic Product (GSDP) to those states who have opted for Option- 1.

- Twenty states have given their preferences for Option-1. However, eight states are yet to exercise an option.

Subscribe

Login

0 Comments