PMO denies RTI plea seeking info on PM-CARES

What does the RTI Act say?

Section 2(h) of the RTI Act, 2005

- Under section 2(h) of the RTI Act “Public authority” means any authority or body or institution of self government established or constituted—

- by or under the Constitution;

- by any other law made by Parliament;

- by any other law made by State Legislature;

- by notification issued or order made by the appropriate Government, and includes any

- body owned, controlled or substantially financed;

- Non-Government organization substantially financed, directly or indirectly by funds provided by the appropriate Government.

- In 2019, the Supreme Court ruled that the office of the Chief Justice of India (CJI) is also a public authority under the RTI Act, 2005.

Section 8 of the RTI

- This provides for exemption from disclosure of information that are more valid in reasons

- Which would affect the sovereignty and integrity of India, the security, strategic, scientific or economic interests of the State;

- Which has been expressly forbidden to be published by any court of law or tribunal;

- Which would cause a breach of privilege of Parliament or the State Legislature;

- Information including commercial confidence, trade secrets or intellectual property;

- Information received in confidence from foreign government;

- Information which would endanger the life or physical safety of any person; etc.

Section 7(9) of the RTI

- According to Section 7(9) of RTI, an information shall ordinarily be provided in the form in which it is sought unless it would disproportionately divert the resources of the public authority or would be detrimental to the safety or preservation of the record in question.

What is PM CARES?

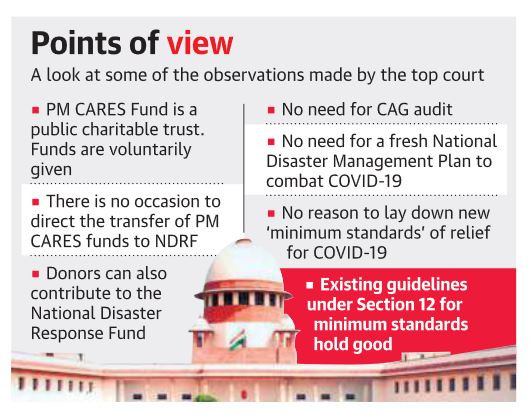

- The PM CARES Fund is a public charitable trust with the Prime Minister as its Chairman, Defence Minister, Home Minister and Finance Minister as its members. It was created on 28 March 2020 following the COVID-19 pandemic in India.

- The Fund enables micro-donations as a result of which a large number of people will be able to contribute

- It aids disaster management capacities and enables more research on the calamity and protection of the general public.

- The Ministry of Corporate Affairs has clarified that contributions by companies towards the PM-CARES Fund will count towards mandatory Corporate Social Responsibility (CSR) expenditure.

What are the concerns?

- Critics of the PM-CARES mechanism allege lack of transparency in functioning of the fund.

- An existing mechanism- PM National Relief Fund (PMNRF)- have similar functions of PM CARES.

- Previous guidelines stated that CSR should not be used to fund government schemes. Contributions to PMNRF and Chief Minister’s relief funds are not qualified as CSR expenditure.

- Double benefit of tax exemption would be a “regressive incentive” if corporates use CSR contributions in PM CARES.

- PM-CARES is also exempted from the Foreign Contribution (Regulation) Act, 2010, and accepts foreign contributions.

Why in News?

- The Prime Minister’s Office (PMO) has denied a Right to Information request related to the PM-CARES Fund on the grounds that providing it would “disproportionately divert the resources of the office” under Section 7(9) of the Right to Information Act, 2005.

Previous judgement

- In a 2010 judgement, the Kerala High Court dismissed the possibility of using clause Section 7(9) to deny information.

- Section 7(9) does not even confer any discretion on a public authority to withhold Information, let alone any exemption from disclosure.

- It only gives discretion to the public authority to provide the information in a form other than the form in which the information is sought for.

Related information

About CSR

- Under the Companies Act, 2013, companies with a minimum net worth of Rs 500 crore or turnover of Rs 1,000 crore, or net profit of Rs 5 crore are required to spend at least 2% of their average profit for the previous three years on CSR activities every year.

Reference:

- https://www.thehindu.com/news/national/pmo-denies-rti-plea-seeking-info-on-pm-cares/article32369180.ece

Subscribe

Login

0 Comments